All Categories

Featured

Table of Contents

- – How much does Level Term Life Insurance Protec...

- – Where can I find Level Term Life Insurance Quo...

- – How much does Term Life Insurance With Fixed ...

- – Why is Level Term Life Insurance Rates import...

- – Who are the cheapest Level Term Life Insuran...

- – Who offers Term Life Insurance With Fixed Pr...

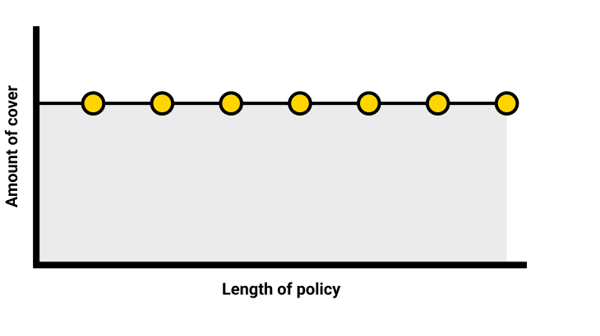

With degree term insurance, the expense of the insurance coverage will stay the exact same (or possibly lower if dividends are paid) over the term of your policy, normally 10 or two decades. Unlike irreversible life insurance policy, which never expires as lengthy as you pay costs, a degree term life insurance policy policy will certainly finish eventually in the future, commonly at the end of the duration of your degree term.

Since of this, many people utilize long-term insurance as a secure monetary preparation device that can offer several needs. You might be able to convert some, or all, of your term insurance during a set period, typically the initial 10 years of your policy, without needing to re-qualify for insurance coverage also if your wellness has altered.

How much does Level Term Life Insurance Protection cost?

As it does, you may intend to add to your insurance policy coverage in the future. When you initially get insurance, you might have little financial savings and a huge home loan. Eventually, your cost savings will certainly grow and your home loan will certainly diminish. As this happens, you may desire to ultimately lower your death advantage or think about converting your term insurance policy to a long-term policy.

Long as you pay your costs, you can relax easy knowing that your enjoyed ones will certainly receive a death benefit if you die throughout the term (Level death benefit term life insurance). Many term policies enable you the capability to convert to permanent insurance coverage without needing to take another health and wellness exam. This can permit you to make use of the added benefits of a permanent plan

Many irreversible plans will certainly have provisions, which specify these tax requirements. There are 2 basic classifications of permanent insurance policy, standard and interest-sensitive, each with a variety of variations. On top of that, each classification is normally readily available in either fixed-dollar or variable type. Traditional whole life plans are based upon long-lasting quotes of expense, interest and death.

If these price quotes transform in later years, the company will certainly adjust the costs appropriately but never ever above the maximum assured costs mentioned in the policy. An economatic entire life policy supplies for a fundamental quantity of getting involved entire life insurance policy with an added supplemental protection supplied through making use of rewards.

Where can I find Level Term Life Insurance Quotes?

Since the costs are paid over a shorter span of time, the premium settlements will be greater than under the entire life strategy. Single premium whole life is restricted settlement life where one huge premium payment is made. The plan is completely paid up and no additional costs are needed.

Since a significant payment is included, it ought to be viewed as an investment-oriented product. Rate of interest in single costs life insurance policy is largely as a result of the tax-deferred therapy of the accumulation of its cash values. Taxes will certainly be sustained on the gain, however, when you surrender the plan. You might obtain on the cash money value of the policy, however keep in mind that you may incur a significant tax obligation costs when you give up, also if you have borrowed out all the money worth.

The benefit is that improvements in rates of interest will certainly be reflected more promptly in interest sensitive insurance coverage than in conventional; the negative aspect, of course, is that lowers in rates of interest will likewise be felt extra rapidly in rate of interest delicate whole life. There are four fundamental passion sensitive entire life plans: The global life policy is really greater than passion delicate as it is designed to mirror the insurer's existing mortality and expenditure as well as passion revenues instead of historic rates.

How much does Term Life Insurance With Fixed Premiums cost?

The business credit scores your costs to the money value account. Regularly the business subtracts from the cash value account its costs and the expense of insurance defense, normally called the mortality deduction fee. The balance of the money value account accumulates at the rate of interest credited. The company assures a minimum rates of interest and a maximum death cost.

Existing assumptions are essential to interest delicate items such as Universal Life. Universal life is likewise the most adaptable of all the different kinds of plans.

The plan normally provides you an option to choose a couple of sorts of death benefits. Under one option your recipients got only the face amount of the policy, under the other they obtain both the face quantity and the cash money worth account. If you want the optimum quantity of fatality benefit currently, the 2nd choice ought to be selected.

It is very important that these presumptions be reasonable due to the fact that if they are not, you may need to pay more to keep the policy from lowering or expiring. On the various other hand, if your experience is better after that the assumptions, than you might be able in the future to miss a costs, to pay less, or to have the strategy compensated at an early day.

Why is Level Term Life Insurance Rates important?

On the various other hand, if you pay more, and your presumptions are reasonable, it is possible to pay up the policy at a very early day (Best value level term life insurance). If you surrender a global life policy you may get less than the cash money worth account as a result of abandonment fees which can be of 2 types

A back-end type policy would certainly be more suitable if you plan to keep insurance coverage, and the cost lowers with each year you continue the plan. Keep in mind that the interest price and expense and death costs payables initially are not guaranteed for the life of the plan. This type of plan provides you maximum flexibility, you will need to proactively handle the policy to maintain adequate financing, specifically because the insurance policy business can enhance death and expense costs.

You might be asked to make extra premium settlements where coverage might terminate because the passion rate went down. The guaranteed rate offered for in the policy is much reduced (e.g., 4%).

In either situation you need to obtain a certification of insurance policy defining the provisions of the group policy and any kind of insurance policy fee - Level term life insurance coverage. Typically the maximum amount of insurance coverage is $220,000 for a home mortgage funding and $55,000 for all other debts. Credit history life insurance policy need not be purchased from the organization approving the financing

Who are the cheapest Level Term Life Insurance Quotes providers?

If life insurance policy is needed by a lender as a condition for making a lending, you might have the ability to appoint an existing life insurance policy policy, if you have one. Nonetheless, you might want to get group credit life insurance policy despite its greater cost due to the fact that of its ease and its availability, typically without detailed evidence of insurability.

In many cases, however, home collections are not made and costs are sent by mail by you to the agent or to the company. There are certain elements that have a tendency to enhance the expenses of debit insurance policy even more than normal life insurance policy strategies: Particular expenses are the exact same regardless of what the size of the plan, to make sure that smaller policies released as debit insurance policy will certainly have higher premiums per $1,000 of insurance than larger size normal insurance coverage.

Since very early gaps are pricey to a firm, the costs have to be handed down to all debit policyholders. Since debit insurance coverage is developed to include home collections, greater commissions and charges are paid on debit insurance policy than on regular insurance coverage. In a lot of cases these higher expenditures are handed down to the policyholder.

Where a business has different premiums for debit and normal insurance coverage it might be possible for you to purchase a bigger quantity of routine insurance policy than debit at no additional expense. Therefore, if you are believing of debit insurance policy, you ought to absolutely investigate regular life insurance policy as a cost-saving choice.

Who offers Term Life Insurance With Fixed Premiums?

This strategy is developed for those who can not originally pay for the normal whole life costs yet that want the higher costs insurance coverage and feel they will eventually be able to pay the greater premium. Level term life insurance for seniors. The family plan is a mix strategy that gives insurance coverage security under one agreement to all members of your prompt household other half, spouse and children

Joint Life and Survivor Insurance policy gives coverage for two or more individuals with the survivor benefit payable at the death of the last of the insureds. Costs are significantly reduced under joint life and survivor insurance coverage than for plans that insure only one individual, because the likelihood of needing to pay a fatality case is reduced.

Table of Contents

- – How much does Level Term Life Insurance Protec...

- – Where can I find Level Term Life Insurance Quo...

- – How much does Term Life Insurance With Fixed ...

- – Why is Level Term Life Insurance Rates import...

- – Who are the cheapest Level Term Life Insuran...

- – Who offers Term Life Insurance With Fixed Pr...

Latest Posts

Instant Insurance Life Smoker

Selling Final Expense Insurance Over The Phone

Best Funeral Insurance Companies

More

Latest Posts

Instant Insurance Life Smoker

Selling Final Expense Insurance Over The Phone

Best Funeral Insurance Companies