All Categories

Featured

Table of Contents

- – What should I look for in a 30-year Level Term...

- – Who provides the best 20-year Level Term Life ...

- – What types of 20-year Level Term Life Insuran...

- – What happens if I don’t have Level Term Life ...

- – Where can I find Fixed Rate Term Life Insura...

- – How does Level Term Life Insurance Coverage ...

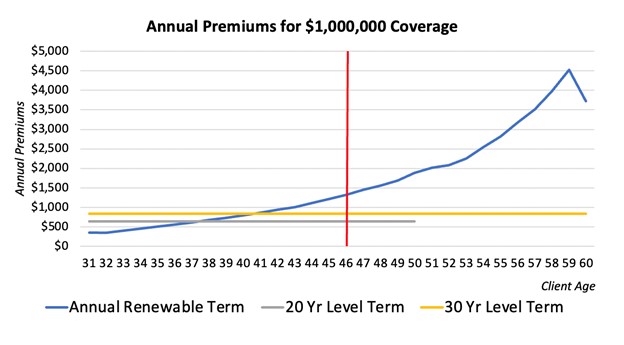

With degree term insurance policy, the cost of the insurance will stay the very same (or potentially decrease if rewards are paid) over the regard to your plan, generally 10 or 20 years. Unlike permanent life insurance policy, which never expires as lengthy as you pay costs, a level term life insurance policy plan will certainly end eventually in the future, usually at the end of the period of your degree term.

Since of this, several individuals make use of permanent insurance policy as a steady economic preparation tool that can offer lots of needs. You may be able to convert some, or all, of your term insurance throughout a set period, usually the first ten years of your plan, without needing to re-qualify for coverage even if your health has actually transformed.

What should I look for in a 30-year Level Term Life Insurance plan?

As it does, you may want to add to your insurance protection in the future. As this happens, you might desire to ultimately reduce your fatality advantage or take into consideration converting your term insurance policy to a long-term policy.

As long as you pay your premiums, you can rest easy recognizing that your loved ones will certainly get a death advantage if you die throughout the term. Many term policies allow you the ability to transform to permanent insurance coverage without having to take an additional health and wellness test. This can allow you to benefit from the added advantages of a long-term plan

Several permanent policies will certainly contain provisions, which specify these tax obligation needs. There are two fundamental classifications of long-term insurance coverage, standard and interest-sensitive, each with a variety of variations. On top of that, each group is normally offered in either fixed-dollar or variable form. Standard whole life plans are based upon lasting estimates of cost, rate of interest and death.

If these quotes change in later years, the business will change the premium accordingly but never above the optimum assured costs stated in the policy. An economatic entire life policy attends to a standard amount of participating whole life insurance policy with an additional extra coverage provided with the use of dividends.

Who provides the best 20-year Level Term Life Insurance?

Due to the fact that the premiums are paid over a shorter period of time, the costs settlements will certainly be greater than under the entire life strategy. Solitary costs whole life is restricted settlement life where one big exceptional settlement is made. The plan is totally compensated and no further costs are required.

Tax obligations will certainly be incurred on the gain, however, when you give up the plan. You may borrow on the cash money value of the policy, yet keep in mind that you might incur a considerable tax obligation costs when you surrender, even if you have actually borrowed out all the cash money value.

The advantage is that improvements in passion rates will be mirrored faster in passion delicate insurance policy than in conventional; the drawback, obviously, is that lowers in passion prices will also be felt quicker in passion delicate entire life. There are 4 fundamental interest delicate entire life plans: The global life policy is really more than rate of interest sensitive as it is made to reflect the insurance company's current death and cost in addition to interest profits rather than historical rates.

What types of 20-year Level Term Life Insurance are available?

The company credit histories your premiums to the cash value account. Occasionally the company subtracts from the cash money worth account its expenses and the expense of insurance security, usually described as the death deduction cost.

These guarantees are typically extremely traditional. Present assumptions are essential to rate of interest delicate items such as Universal Life. When rate of interest are high, benefit projections (such as cash money worth) are likewise high - Level term life insurance for seniors. When rates of interest are low, these projections are not as eye-catching. Universal life is likewise one of the most adaptable of all the various type of policies.

The policy normally provides you an alternative to pick a couple of kinds of death benefits. Under one choice your recipients received only the face quantity of the policy, under the various other they get both the face quantity and the cash worth account. If you want the optimum amount of death advantage now, the 2nd option needs to be chosen.

It is very important that these assumptions be practical due to the fact that if they are not, you might have to pay even more to keep the plan from decreasing or lapsing. On the other hand, if your experience is much better then the assumptions, than you may be able in the future to skip a costs, to pay less, or to have actually the plan compensated at an early date.

What happens if I don’t have Level Term Life Insurance Quotes?

On the various other hand, if you pay even more, and your presumptions are sensible, it is possible to compensate the policy at a very early date (Level term life insurance for families). If you surrender an universal life plan you may get much less than the cash money worth account due to the fact that of abandonment charges which can be of two kinds

A back-end type plan would certainly be more suitable if you intend to maintain insurance coverage, and the fee lowers with each year you continue the policy. Remember that the rates of interest and expense and mortality charges payables at first are not ensured for the life of the policy. Although this kind of policy gives you optimal flexibility, you will certainly need to actively handle the policy to keep sufficient financing, specifically due to the fact that the insurer can enhance death and expenditure costs.

You might be asked to make additional costs payments where insurance coverage could end since the rates of interest went down. Your beginning rate of interest is repaired only for a year or sometimes 3 to five years. The guaranteed rate provided for in the plan is much lower (e.g., 4%). An additional feature that is in some cases emphasized is the "no price" finance.

You must get a certificate of insurance coverage describing the stipulations of the group plan and any insurance fee. Usually the maximum amount of coverage is $220,000 for a mortgage and $55,000 for all various other financial debts. Debt life insurance coverage need not be bought from the company providing the car loan

Where can I find Fixed Rate Term Life Insurance?

If life insurance policy is needed by a financial institution as a problem for making a funding, you may be able to appoint an existing life insurance policy plan, if you have one. Nonetheless, you may wish to get group debt life insurance policy even with its greater price since of its ease and its accessibility, usually without thorough proof of insurability.

In the majority of situations, nevertheless, home collections are not made and premiums are sent by mail by you to the agent or to the firm. There are specific factors that have a tendency to enhance the costs of debit insurance greater than normal life insurance strategies: Particular expenditures coincide no issue what the dimension of the policy, so that smaller policies issued as debit insurance will have higher premiums per $1,000 of insurance coverage than larger dimension normal insurance coverage.

Since very early gaps are pricey to a firm, the expenses must be handed down to all debit policyholders. Given that debit insurance coverage is developed to consist of home collections, greater compensations and charges are paid on debit insurance than on regular insurance coverage. In most cases these higher expenses are handed down to the insurance policy holder.

Where a company has different costs for debit and regular insurance coverage it may be possible for you to acquire a larger amount of regular insurance coverage than debit at no extra cost. Consequently, if you are thinking about debit insurance coverage, you should certainly check out normal life insurance policy as a cost-saving choice.

How does Level Term Life Insurance Coverage work?

This strategy is developed for those who can not initially pay for the regular entire life premium yet that want the greater costs protection and feel they will become able to pay the greater premium. Level term life insurance for families. The family members plan is a mix plan that offers insurance defense under one contract to all members of your prompt family husband, better half and kids

Joint Life and Survivor Insurance supplies coverage for two or even more persons with the fatality benefit payable at the fatality of the last of the insureds. Premiums are significantly reduced under joint life and survivor insurance policy than for policies that insure just one individual, since the chance of having to pay a death claim is lower.

Table of Contents

- – What should I look for in a 30-year Level Term...

- – Who provides the best 20-year Level Term Life ...

- – What types of 20-year Level Term Life Insuran...

- – What happens if I don’t have Level Term Life ...

- – Where can I find Fixed Rate Term Life Insura...

- – How does Level Term Life Insurance Coverage ...

Latest Posts

Instant Insurance Life Smoker

Selling Final Expense Insurance Over The Phone

Best Funeral Insurance Companies

More

Latest Posts

Instant Insurance Life Smoker

Selling Final Expense Insurance Over The Phone

Best Funeral Insurance Companies