All Categories

Featured

Table of Contents

Nevertheless, keeping all of these acronyms and insurance policy types straight can be a headache - for home loan insurance is mandatory. The following table positions them side-by-side so you can quickly distinguish amongst them if you obtain perplexed. Another insurance policy coverage kind that can repay your home loan if you die is a typical life insurance plan

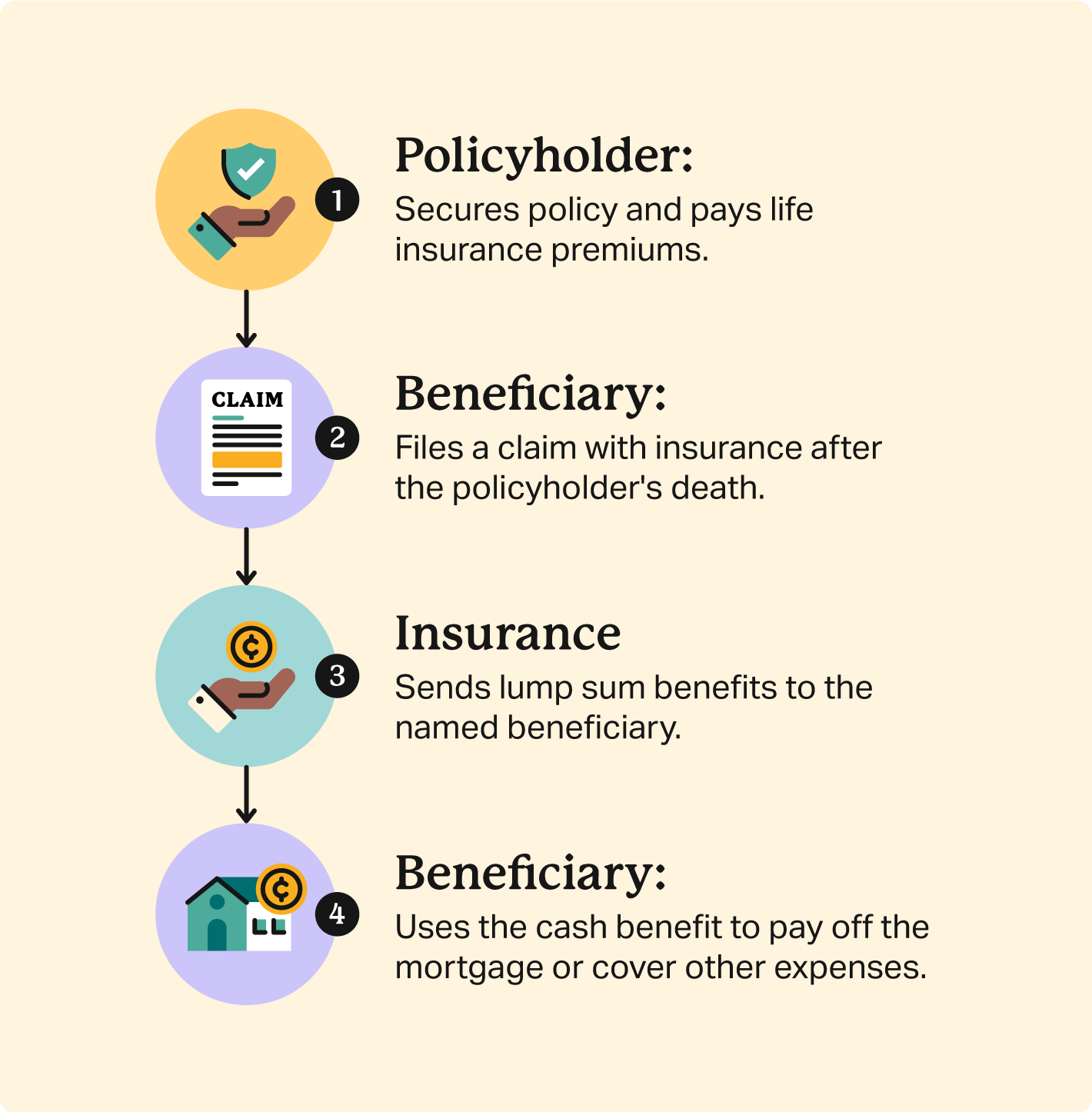

A remains in area for a set variety of years, such as 10, 20 or thirty years, and pays your beneficiaries if you were to pass away during that term. A gives protection for your entire life expectancy and pays out when you pass away. Rather than paying your mortgage lending institution straight the way home mortgage security insurance policy does, common life insurance coverage policies most likely to the recipients you choose, that can after that pick to settle the home mortgage.

One usual policy of thumb is to go for a life insurance plan that will certainly pay as much as 10 times the policyholder's wage quantity. Conversely, you might pick to use something like the penny approach, which adds a family members's debt, revenue, home mortgage and education and learning expenditures to compute how much life insurance policy is required (mortgage life insurance age limit).

There's a reason brand-new home owners' mailboxes are often pestered with "Last Possibility!" and "Urgent! Activity Needed!" letters from mortgage protection insurers: Several only permit you to acquire MPI within 24 months of shutting on your home mortgage. It's also worth keeping in mind that there are age-related restrictions and limits enforced by nearly all insurance firms, who frequently won't offer older purchasers as numerous alternatives, will bill them a lot more or might deny them outright.

Below's how home loan security insurance policy determines up versus basic life insurance. If you're able to certify for term life insurance coverage, you should avoid home mortgage defense insurance (MPI).

In those situations, MPI can offer wonderful peace of mind. Every mortgage security alternative will have many rules, guidelines, advantage alternatives and downsides that require to be considered carefully against your precise scenario.

Mortgage And Critical Illness Cover

A life insurance policy can help pay off your home's home loan if you were to die. It is just one of numerous manner ins which life insurance policy may aid protect your liked ones and their monetary future. Among the very best means to factor your mortgage into your life insurance policy requirement is to talk with your insurance policy representative.

Rather than a one-size-fits-all life insurance plan, American Domesticity Insurance provider supplies plans that can be made especially to satisfy your household's needs. Below are a few of your choices: A term life insurance policy policy. mortgage protection calculator is active for a certain quantity of time and normally supplies a larger amount of protection at a reduced price than an irreversible policy

A whole life insurance policy plan is just what it seems like. As opposed to only covering a set number of years, it can cover you for your entire life. It also has living advantages, such as cash worth build-up. * American Domesticity Insurer supplies various life insurance policy plans. Speak with your agent regarding tailoring a plan or a combination of plans today and getting the satisfaction you are entitled to.

Your agent is a great source to answer your concerns. They might also be able to aid you locate gaps in your life insurance protection or new means to save on your various other insurance coverage. ***Yes. A life insurance policy recipient can choose to make use of the death benefit for anything - cheapest home loan insurance. It's a wonderful means to aid secure the monetary future of your household if you were to die.

Life insurance policy is one means of helping your family in paying off a home loan if you were to pass away before the home loan is completely repaid. Life insurance policy profits may be made use of to help pay off a home loan, however it is not the same as home mortgage insurance coverage that you may be required to have as a problem of a funding.

Insurance To Pay Mortgage In Case Of Death

Life insurance policy might assist guarantee your home remains in your family by giving a survivor benefit that might aid pay for a home mortgage or make essential purchases if you were to pass away. Call your American Household Insurance policy representative to review which life insurance coverage policy best fits your needs. This is a short summary of coverage and is subject to plan and/or cyclist conditions, which may vary by state.

The words lifetime, lifelong and long-term are subject to plan terms. * Any loans drawn from your life insurance policy policy will certainly accrue interest. mortgage protection loss of job. Any kind of impressive loan equilibrium (lending plus interest) will be subtracted from the death advantage at the time of insurance claim or from the cash value at the time of surrender

** Topic to plan terms and problems. ***Discount rates might differ by state and company underwriting the automobile or house owners policy. Price cuts might not use to all insurance coverages on an auto or home owners plan. Price cuts do not put on the life plan. Policy Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

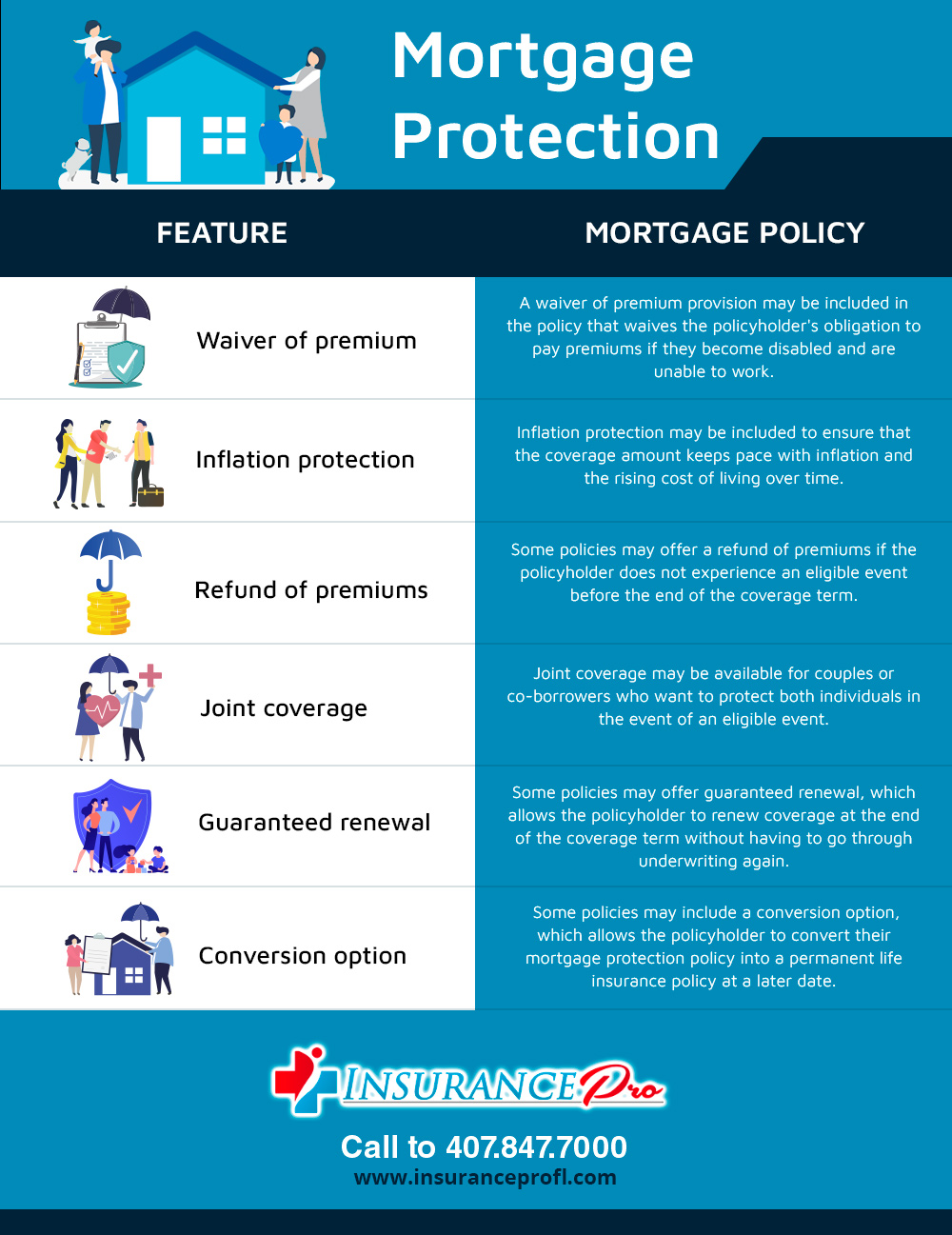

Home mortgage protection insurance (MPI) is a various kind of secure that can be handy if you're incapable to repay your mortgage. While that added protection appears great, MPI isn't for every person. Below's when home mortgage protection insurance coverage is worth it. Mortgage security insurance policy is an insurance coverage that repays the rest of your home mortgage if you die or if you end up being handicapped and can't function.

Both PMI and MIP are needed insurance coverages. The amount you'll pay for mortgage protection insurance depends on a variety of variables, including the insurance company and the current equilibrium of your mortgage.

Still, there are pros and cons: Many MPI policies are provided on a "ensured acceptance" basis. That can be beneficial if you have a health and wellness problem and pay high rates permanently insurance policy or struggle to obtain protection. is mortgage insurance required by law. An MPI policy can give you and your household with a complacency

Life Insurance With No Mortgage

You can select whether you require home loan security insurance and for exactly how long you need it. You might want your home loan protection insurance coverage term to be close in size to how long you have actually left to pay off your mortgage You can cancel a home loan protection insurance coverage plan.

Latest Posts

Instant Insurance Life Smoker

Selling Final Expense Insurance Over The Phone

Best Funeral Insurance Companies