All Categories

Featured

Table of Contents

Insurer will not pay a small. Instead, think about leaving the cash to an estate or depend on. For even more thorough details on life insurance policy obtain a duplicate of the NAIC Life Insurance Policy Purchasers Overview.

The IRS places a restriction on how much cash can go right into life insurance policy premiums for the plan and just how quickly such premiums can be paid in order for the plan to keep every one of its tax obligation benefits. If particular limitations are surpassed, a MEC results. MEC policyholders may undergo tax obligations on circulations on an income-first basis, that is, to the degree there is gain in their policies, in addition to fines on any kind of taxable quantity if they are not age 59 1/2 or older.

Please note that superior loans build up passion. Earnings tax-free treatment additionally assumes the funding will become satisfied from earnings tax-free death advantage earnings. Finances and withdrawals reduce the policy's cash money worth and death advantage, may trigger particular policy benefits or riders to become unavailable and may increase the opportunity the policy might gap.

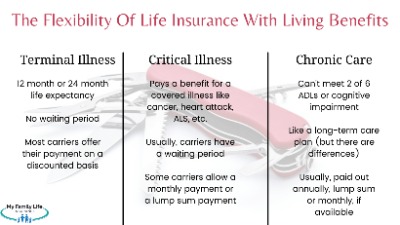

4 This is offered via a Long-term Treatment Servicessm biker, which is available for an added charge. Furthermore, there are constraints and constraints. A customer might get the life insurance policy, however not the cyclist. It is paid as a velocity of the death benefit. A variable global life insurance policy agreement is an agreement with the key purpose of offering a survivor benefit.

How do I compare Riders plans?

These profiles are closely managed in order to please stated financial investment goals. There are fees and charges related to variable life insurance policy agreements, including mortality and danger fees, a front-end lots, administrative costs, financial investment administration fees, abandonment costs and costs for optional bikers. Equitable Financial and its affiliates do not provide legal or tax recommendations.

And that's fantastic, since that's exactly what the fatality benefit is for.

What are the benefits of entire life insurance policy? Here are several of the crucial points you should know. One of the most attractive benefits of purchasing a whole life insurance policy policy is this: As long as you pay your costs, your death advantage will never ever run out. It is ensured to be paid regardless of when you die, whether that's tomorrow, in five years, 80 years and even additionally away. Family protection.

Assume you do not need life insurance coverage if you do not have youngsters? There are many advantages to having life insurance policy, also if you're not sustaining a household.

What is included in Riders coverage?

Funeral expenses, funeral expenses and clinical costs can add up (Long term care). The last thing you want is for your liked ones to shoulder this added concern. Irreversible life insurance policy is offered in various quantities, so you can choose a fatality benefit that meets your demands. Alright, this only uses if you have children.

Identify whether term or irreversible life insurance coverage is appropriate for you. After that, get a price quote of how much protection you may require, and just how much it could set you back. Discover the best quantity for your spending plan and comfort. Locate your amount. As your individual scenarios modification (i.e., marriage, birth of a kid or job promotion), so will certainly your life insurance policy needs.

Generally, there are two sorts of life insurance coverage plans - either term or irreversible plans or some mix of both. Life insurance firms supply numerous types of term strategies and conventional life policies in addition to "rate of interest sensitive" products which have become much more common because the 1980's.

Term insurance provides protection for a specific period of time. This duration can be as brief as one year or give insurance coverage for a details number of years such as 5, 10, two decades or to a specified age such as 80 or in some situations approximately the earliest age in the life insurance policy mortality.

What happens if I don’t have Level Term Life Insurance?

Presently term insurance policy prices are extremely competitive and among the most affordable traditionally seasoned. It must be kept in mind that it is a widely held idea that term insurance coverage is the least costly pure life insurance policy protection available. One requires to examine the plan terms carefully to choose which term life options are suitable to meet your particular situations.

With each new term the costs is increased. The right to restore the policy without evidence of insurability is an important advantage to you. Otherwise, the threat you take is that your health and wellness might wear away and you might be not able to obtain a plan at the same rates or perhaps whatsoever, leaving you and your recipients without coverage.

The length of the conversion duration will certainly vary depending on the kind of term policy purchased. The premium rate you pay on conversion is usually based on your "existing attained age", which is your age on the conversion day.

Under a degree term policy the face amount of the plan continues to be the very same for the whole duration. With lowering term the face quantity reduces over the duration. The premium stays the exact same every year. Commonly such policies are offered as mortgage security with the amount of insurance coverage reducing as the balance of the home mortgage reduces.

How can I secure Level Term Life Insurance quickly?

Typically, insurance companies have not can alter costs after the plan is marketed. Given that such policies might proceed for years, insurance firms have to utilize conservative mortality, passion and expense price quotes in the premium calculation. Flexible premium insurance coverage, nonetheless, enables insurance firms to offer insurance coverage at reduced "present" premiums based upon less conventional presumptions with the right to alter these costs in the future.

While term insurance is designed to give defense for a specified time period, irreversible insurance coverage is made to supply protection for your entire life time. To maintain the costs rate level, the premium at the younger ages goes beyond the real price of security. This additional premium develops a reserve (cash money worth) which assists spend for the plan in later years as the price of security surges above the costs.

The insurance coverage business invests the excess premium dollars This kind of plan, which is often called money worth life insurance coverage, produces a financial savings aspect. Money worths are crucial to a long-term life insurance policy.

Latest Posts

What is What Does Level Term Life Insurance Mean? The Key Points?

What is Life Insurance? Learn the Basics?

Riders