All Categories

Featured

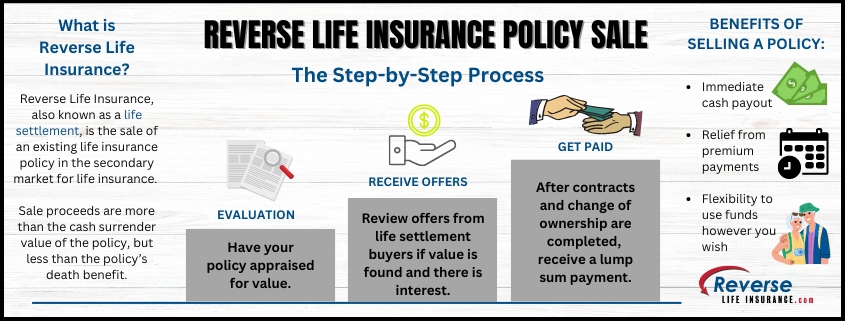

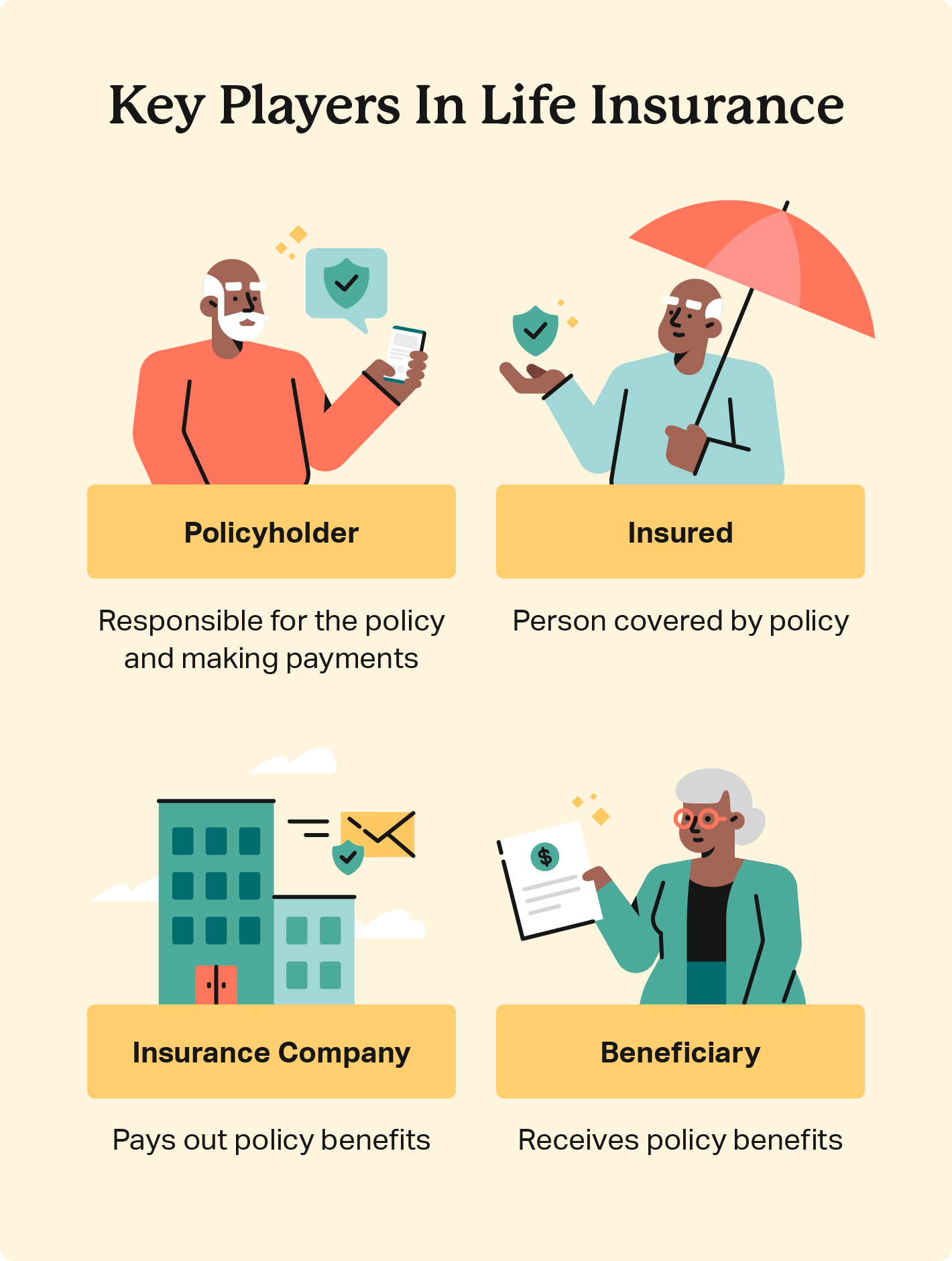

Cash money worth is a living benefit that stays with the insurer when the insured dies. Any kind of outstanding finances against the money worth will certainly minimize the policy's death benefit. Retirement planning. The policy proprietor and the guaranteed are usually the exact same individual, yet occasionally they might be different. For instance, an organization might acquire key person insurance policy on a crucial worker such as a CHIEF EXECUTIVE OFFICER, or a guaranteed might sell their own plan to a third celebration for money in a life negotiation.

Latest Posts

Riders

Published Dec 23, 24

1 min read

What Makes Guaranteed Level Term Life Insurance Different?

Published Dec 22, 24

6 min read

How long does Universal Life Insurance coverage last?

Published Dec 19, 24

6 min read